10/01/2025

Local Impact, Personal Touch: 4 Community Banking Benefits

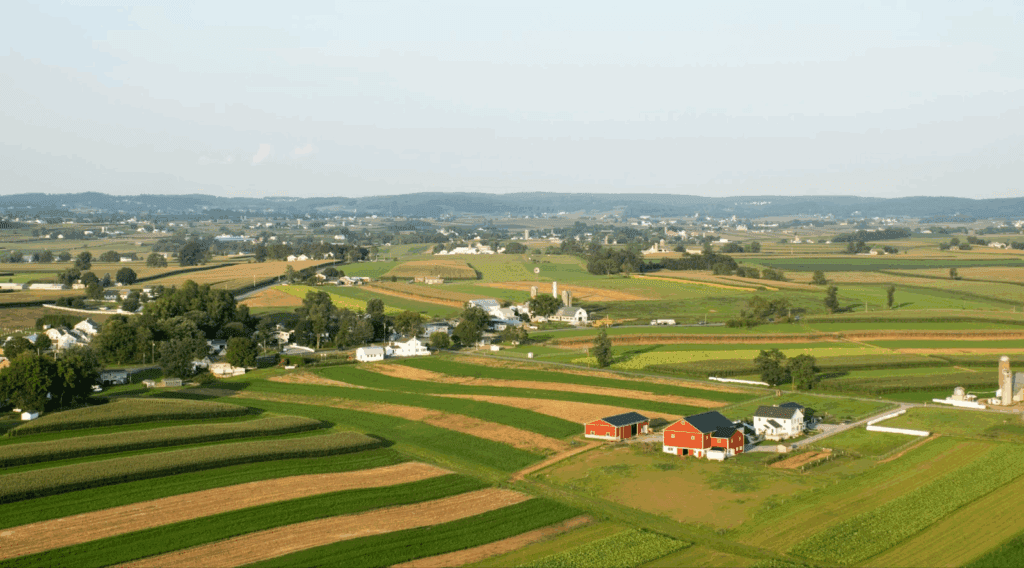

In a world full of massive, globe-spanning banks, it’s easy to overlook community banking. But when you look closer, you’ll see local banks offer a personal touch and real strength right where you live. Continue reading to learn more about community banking benefits and how Bank of Bird-in-Hand can serve you.

What Is a Community Bank?

When exploring banking options, you’ll often encounter three main categories: large national or international banks, regional banks, and community banks. While all three offer essential financial services, a community bank operates with a distinctly different philosophy and structure.

So, what is a community bank?

At its core, community banking prioritizes the needs of the individuals, families, and businesses within the areas it serves. Unlike large corporations with branches across the globe, or even regional banks, community banks are often locally owned and operated, meaning their decision-makers live and work right in the neighborhoods where their customers reside.

This local presence translates into several key characteristics, including but not limited to:

- Relationship-based banking.

- Local decision-making.

- Tailored services and products.

- Community involvement.

- Accessibility and personal support.

Simply put, a community bank is more than just a place to keep your money; it’s a financial partner dedicated to the prosperity of its neighbors and the overall health of the community it calls home.

4 Community Banking Benefits

Now that we’ve covered the question, “What is a community bank?” you may be wondering, “Why choose a community bank?” Below, we’ve broken down four community banking benefits that can make a significant difference for local individuals and businesses.

- Personalized Service & Relationships

One of the biggest community banking benefits is the emphasis on face-to-face service and building strong relationships. Unlike larger institutions that often focus on digital banking and technology, community banks prioritize fostering genuine connections with customers.

At Bank of Bird-in-Hand, customers can sit down with a trusted community banker to discuss financial hurdles or get account assistance. This supportive environment encourages open conversation and allows customers to receive the support they need from someone they trust, rather than an unfamiliar employee at a large bank.

- Faster Loan Decisions & Flexibility With Services

A significant advantage of community banking is the opportunity for faster decisions and greater flexibility when it comes to personal and business loans and other banking services. Since local banks are deeply connected to their communities, they truly understand the needs of customers and businesses.

This insight into local challenges, opportunities, and market conditions allows community banks to offer tailored services and products that provide real solutions. Furthermore, at a local bank, the person reviewing your loan request is likely someone you’ve already built a relationship with. This local decision-making process cuts through unnecessary bureaucracy, providing quicker access to funds.

- Increased Stability & Competitive Rates

Another significant community banking benefit is their stability and resiliency. Being rooted in their local economies makes them better equipped to handle economic instability and adjust to local conditions. Since Community Banks operate on a smaller scale and know their customers and the surrounding area, they can offer more personalized services and products, which could translate to competitive rates and fewer fees for their customers.

- Community Investment & Improved Customer Service

Beyond banking services, another community banking benefit is investing in and supporting their communities in various ways. For example, Bank of Bird-in-Hand actively contributes to the community by sponsoring events, donating to local charities, and more, all of which strengthen the community as a whole.

Finally, community banking generally offers superior customer service and accessibility compared to larger institutions, which often aren’t as attuned to local needs. Because they are familiar with their communities’ unique circumstances, they can provide better support, prioritize personal relationships, and consistently go above and beyond to deliver excellent service.

Why Choose Bank of Bird-in-Hand?

We’ve talked about community banking benefits, now it’s time to discuss why you should consider Bank of Bird-in-Hand as your community bank. Continue reading to learn more about our values as a community bank and how we can serve you better.

Our Deep Understanding of Local Industries

Unlike national chains, we understand the specific cycles, challenges, and opportunities within these key regional industries. Whether it’s specialized loan products for farming equipment or flexible financing for a small business, we can support our customers in a way that a large, one-size-fits-all bank might not.

We Believe in Building Relationships

If you’re running an agriculture business in Lancaster or a local restaurant in Lykens Valley, Bank of Bird-in-Hand will sit down with you to learn about your needs so we can provide the proper support. We value the relationships that larger banks often overlook because we know they are the backbone of the community.

Our Responsiveness to Local Economic Shifts

When a specific industry faces headwinds, like a dip in agricultural prices or a change in manufacturing demand, we’re willing to adapt to support our local businesses through challenging times rather than simply maximizing profits for distant shareholders. This is because we have a vested interest in our community’s resilience.

We Invest In Our Community

For us, being a community bank means actively helping our neighbors in ways that go far beyond typical banking. We’re deeply committed to giving back and creating a positive impact. As your local Pennsylvania community bank, we’re dedicated to providing the support and resources that help businesses and organizations throughout our neighborhoods and surrounding areas truly thrive.

Our Local Services and Decision-Making

Imagine being a small business owner in Ephrata, Intercourse, or Manheim. When you need a loan or have a complex financial question, you can walk into our local community bank and speak directly with a banker who knows you, your business, and the local market. This personalized approach fosters trust and ensures quicker, more flexible solutions.

Looking for community banking solutions? We’re ready to serve you. Get in touch with us today!

Related Blogs

12/02/2025

Bank of Bird-in-Hand Opens Quarryville Branch

12/02/2025

Bank of Bird-in-Hand CEO Attends National Meeting for Community Bank Leaders

11/12/2025

Bank of Bird-in-Hand Named One of the Best Banks to Work For